Hello to all the investors and home sellers out there! The following narrative concerns all of you.

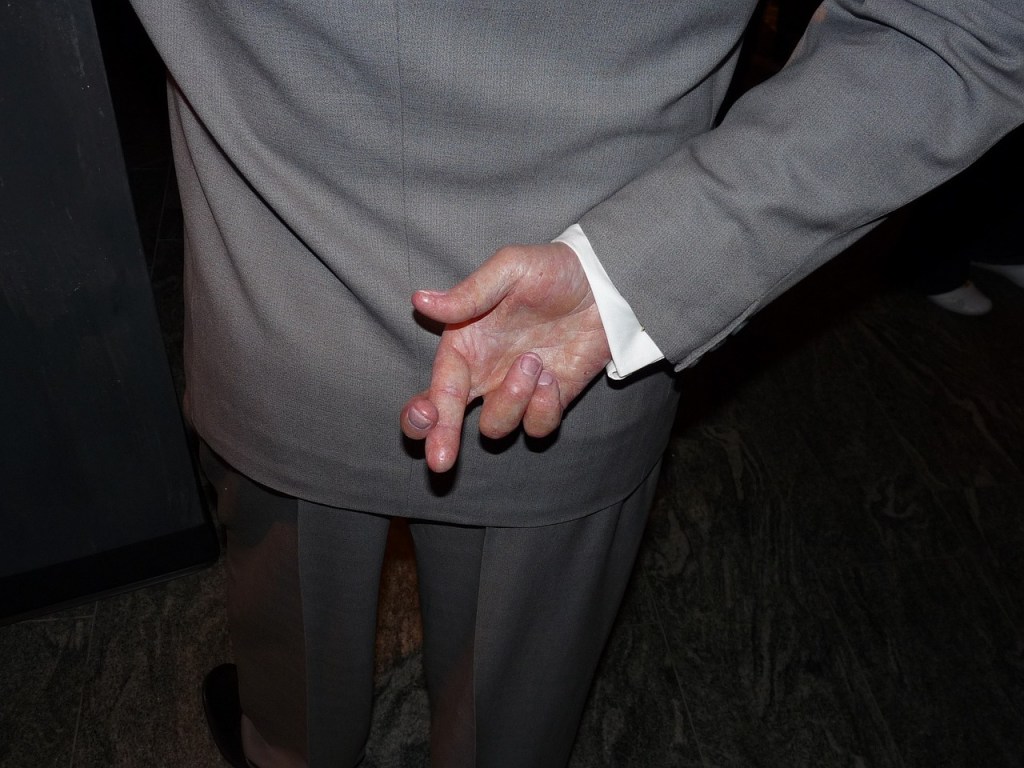

I’ve been in this business for several years, but there’s a concerning trend I feel compelled to address: the notorious “Bait and Switch” tactic. It’s not new, but it needs to be talked about, sooner than later.

For those unfamiliar, here’s how it typically goes: an investor approaches a homeowner desperate for a quick sale with an offer that’s seemingly too good to refuse. Yet, just as the seller gets ready to finalize the deal, usually less than a week before closing, the investor asks for a price reduction. Sound deceitful? It is!

The Common Excuses:

Over-estimating the Property’s Value, Then Backtracking

One of the primary tactics employed by some investors is intentionally inflating the property’s initial valuation. By offering a price that’s significantly higher than the market value, they create an allure that’s hard for sellers to resist. Once the seller is emotionally and mentally committed to the sale, the investor then backpedals, citing various reasons for a reduced offer. This sudden shift not only leaves the seller in a lurch but also raises questions about the credibility and intentions of the investor.

Bringing Up Sudden ‘Repair’ Needs

Another common strategy involves the sudden discovery of ‘necessary repairs’ after an initial agreement on price. These alleged issues might range from foundational problems to aesthetic touch-ups that supposedly decrease the property’s value. While genuine unforeseen issues can arise, the unethical play here is when these repairs are either exaggerated or entirely fabricated to force the seller into accepting a lower price.

Delay Tactics

Stalling the transaction process is a subtle yet effective method employed by some to wear down sellers. By intentionally slowing down the response times, frequently rescheduling meetings, or inundating the process with redundant paperwork, they hope to exhaust the seller. This fatigue, they wager, might push the seller into accepting less favorable terms just to expedite the sale.

Citing Unexpected Financial Problems

This tactic plays on the pretense of financial hardships or unforeseen monetary complications. After agreeing upon a price, an investor might suddenly claim an inability to secure the necessary funds or cite a change in lending terms. By painting a picture of financial constraint, they aim to renegotiate for a lower price, capitalizing on the seller’s empathy or urgency to sell.

Leveraging Undervalued Appraisals

Appraisals are meant to offer an unbiased assessment of a property’s worth. However, some investors might collaborate with appraisers to intentionally undervalue a property. By presenting this low appraisal as evidence that their initial offer was ‘too generous’, they attempt to renegotiate the price downwards. It’s a tactic that not only undercuts the seller but also undermines the trustworthiness of the appraisal process.

Sure, in the short term, this might seem like a clever tactic to save a few bucks, but the long-term repercussions on our reputation are immeasurable.

Now, I’m the first to admit that unexpected issues can arise. I’ve encountered repair problems after an initial inspection. And yes, I’ve been off the mark with repair estimates occasionally. What differentiates the ethical from the unethical is how we handle these unforeseen issues. Transparency and ethics are what I strive for, and my track record proudly echoes that sentiment – 5-STAR Google Rating and a BBB A+ Accreditation. There’s a reason for that! And a reason why I am a trusted Maryland cash home buyer.

Ambushing a seller right before closing? That’s not just bad business; it’s unethical.

Regrettably, some investors don’t see it this way. They’ve turned this tactic into their regular modus operandi, employing it deal after deal, just to edge a bit more profit from the seller.

What’s even more disconcerting is that certain “gurus” are preaching this method in their courses and mentorships, framing it as smart business. Don’t believe me? Well, spend a few bucks on one of their courses and listen very closely to the “renegotiating a contract” section.

But here’s a perspective check: as real estate investors, we aren’t merely trading bricks and mortar. We’re playing a role in people’s lives, with their biggest physical asset.

Here’s My Charge to All Investors:

- Honor your word.

- Commit to what you can genuinely offer.

- Embrace honesty and transparency in every deal.

Remember, our true worth isn’t in the profits we make, but in the integrity we uphold. If you don’t believe that, you shouldn’t be in this business. That’s my two cents.

Let’s shift the narrative.

Let’s redefine the standards of this industry.

Keep it genuine, and let’s elevate the real estate investing world.